Governance

Corporate Governance

Basic Policy on Corporate Governance

Pursuant to our mission, “Empower Small Businesses to Take Center Stage,” the Company’s group recognizes our corporate social responsibility and makes efforts to bring harmonized benefits to our stakeholders.

Thus, the Company will promote a monitoring system for business execution and disclose information in a timely manner in order to ensure transparency and objectivity in our business activities for the development of appropriate corporate management systems.

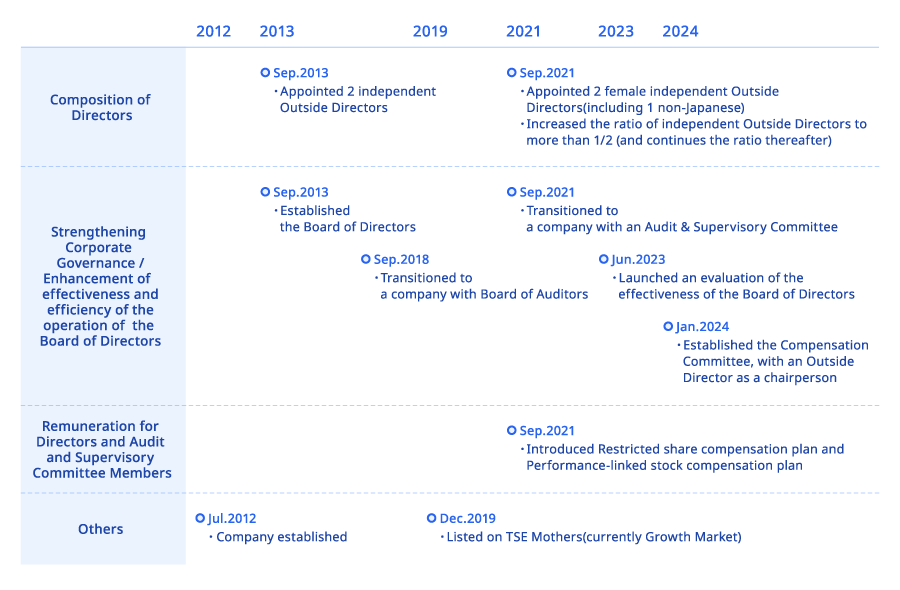

Transition of Corporate Governance Enhancement

Corporate governance system

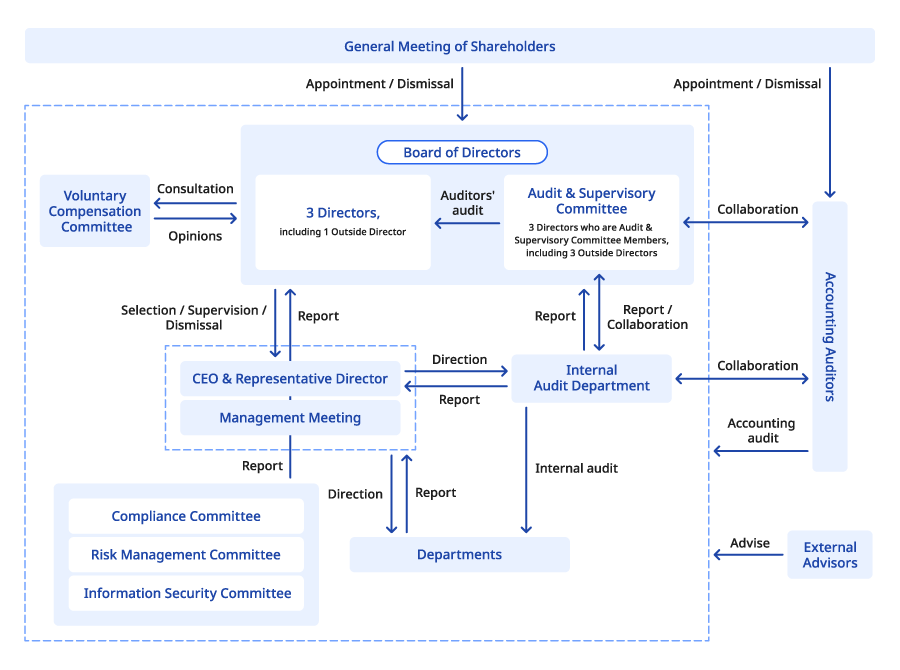

Schematic of the corporate governance system

The Board of Directors

The Board of Directors is composed of three Directors (including one Outside Director): Mr. Daisuke Sasaki (Chairman of the Board of Directors), Mr. Ryu Yokoji, and Ms. Yumi Hosaka Clark (Outside Director), and three Audit and Supervisory Committee Members (including three independent Outside Directors): Ms. Yoko Naito (full-time), Mr. Masao Hirano (part-time), and Mr. Shinji Asada (part-time).

The Board of Directors deliberates on and resolves legally required and important management matters at the regular meetings of the Board, which are held monthly in principle, and extraordinary meetings of the Board, which are held as necessary, with attendance of the Directors and Audit and Supervisory Committee Members. The Board of Directors makes an important decision on the execution of the business and supervises business execution based on the perspectives of Outside Directors.

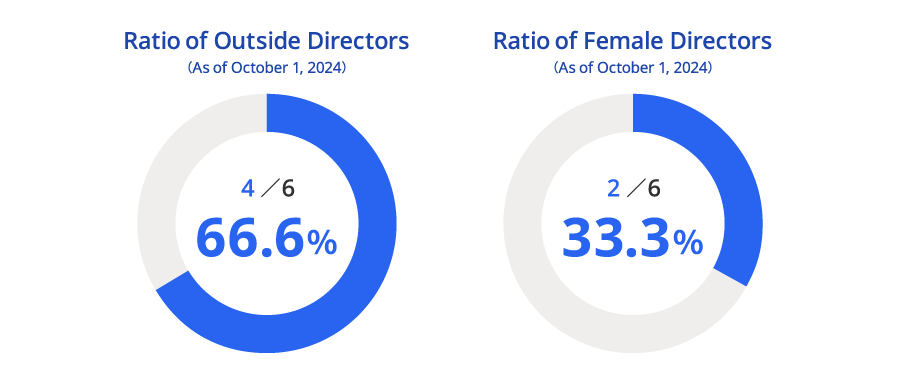

Composition of Directors

Board Activities

In the fiscal year ended June 30, 2024, the Board of Directors held 15 meetings, with a 100% attendance rate for all directors. Specific Resolutions, Reports, and Deliberation Items were as follows:

Specific Resolutions, Reports, and Deliberation Items of the Board of Directors meetings

- Formulation and monitoring of medium- to long-term growth strategies and business plans

- Product strategy

- Investment policy, monitoring of investment targets, and individual M&A cases

- Organizational and human resource strategy

- Compliance and risk management status

- Internal audit status

- Evaluation of the Effectiveness of the Board of Directors

- Other matters for resolution and reporting as stipulated by the Companies Act and the Board of Directors rules

Evaluation of the Effectiveness of the Board of Directors

We conducted a questionnaire survey on the effectiveness of the Board of Directors, targeting Directors (including Directors who are Audit & Supervisory Committee Members), with the aim of evaluating whether or not the Board of Directors is effectively fulfilling its roles and then identifying areas for improvement.

Evaluation Process

A questionnaire survey (collecting both rating scores and qualitative comments) was conducted with all Directors from June to July 2024. Based on each participant’s responses, the Board of Directors’ secretariat conducted individual interviews with each officer to gain a more accurate understanding of their responses, followed by an analysis and evaluation.

Based on the responses to the above questionnaire survey and interviews, a report on the overall assessment, challenges, and improvement measures was presented to the Company’s Board of Directors, after which discussions were held regarding the results and improvement measures.

Overview of Evaluation Results

In summary, we have confirmed that the effectiveness of the Company’s Board of Directors is ensured and that operational improvements are being continuously implemented. Notably, items that were highly evaluated were the transition from discussions on individual execution matters to more strategic discussions, as well as the prior review and sharing of the Board’s annual agenda. On the other hand, it is recognized that there is still room to further enhance the productivity of discussions by improving information provision to outside officers. Therefore, we will implement the improvement measures developed to address these issues.

The Audit and Supervisory Committee

The Company’s Audit & Supervisory Committee consists of three Directors who are Audit & Supervisory Committee Members: Ms. Yoko Naito (full-time), Mr. Masao Hirano (part-time), and Mr. Shinji Asada (part-time). The Audit & Supervisory Committee meeting is held once a month in principle and on an ad-hoc basis as necessary. The Directors who are Audit & Supervisory Committee Members audit and supervise the status of execution of duties by Directors through attendance at the General Meeting of Shareholders and Board of Directors meetings, exercise of their legal rights such as receiving reports from the Directors, employees, and Accounting Auditors. In addition, the Director who is a full-time Audit & Supervisory Committee Member engages in viable monitoring activities including attendance at management meetings and other important meetings and inspection of important documents.

Audit and Supervisory Committee Activities

In the fiscal year ended June 30, 2024, the Audit & Supervisory Committee held 14 meetings, with a 100% attendance rate for all Audit & Supervisory Committee Members.

The Audit & Supervisory Committee’s activities included reporting on audit work performed by each Audit & Supervisory Committee Member, discussions on risk awareness, coordination and information sharing with Internal Auditors and the Accounting Auditor, and exchanges of opinions with each Director and Operating Executive Officer. For the fiscal year ended June 30, 2024, priority audit items included monitoring the execution and efficiency of investments under the medium-term management strategy, monitoring decision-making for M&A and post-investment business operations, and monitoring human resource strategy and development. Quarterly results were reported by the Accounting Auditor, with additional opinion exchanges held as necessary.

Additionally, the full-time Audit & Supervisory Committee Member attended important meetings such as those of the Management Meeting, the Risk Management Committee, the Compliance Committee, and the Investment Committee, reviewed important documents, held hearings with executives and employees, and conducted other daily audit work, utilizing online means when appropriate. She also shared information with part-time Audit & Supervisory Committee Members as needed. Regarding subsidiaries, information was exchanged with their directors and auditors, and important documents were reviewed to investigate their business and property conditions.

The Compensation Committee

The Company has voluntarily established the Compensation Committee as an advisory body to the Board of Directors to discuss the compensation system for Directors and other matters more efficiently while ensuring transparency. The Compensation Committee consists of two members: Daisuke Sasaki, the Representative Director, and Mr. Masao Hirano, an Independent Outside Director. To ensure independence, Mr. Masao Hirano, an Independent Outside Director, is serving as the Chairperson of the committee. The Compensation Committee deliberates and provides opinions to the Board of Directors regarding the compensation system for Directors and other matters based on consultation of the Board of Directors.

Compensation Committee Activities

In the fiscal year ended June 30, 2024, the Compensation Committee held three meetings, with a 100% attendance rate for all committee members. Specific deliberation items were as follows:

Major Items discussed at Compensation Committee meetings

- Evaluation of the compensation system for Directors (including levels and system details)

- Verification of reviews from external research agencies

- Revision of the compensation system for Directors based on external research and compensation system evaluation

Remuneration for Directors and Audit and Supervisory Committee Members

Process of the determination of remuneration

The compensation, etc. for the Company’s Directors (excluding Directors who are Audit and Supervisory Committee Members) is determined by a resolution of the Board of Directors, considering the results of deliberations conducted by the Compensation Committee, which was voluntarily established to ensure transparency, objectivity, and efficient discussions. This determination will include individual amounts and other details within the total compensation amounts approved at the General Meeting of Shareholders for each type of compensation. Additionally, more than half of the members of the Compensation Committee will be Outside Directors. The individual compensation, etc. for Directors who are Audit & Supervisory Committee Members will be determined through consultation among the Audit & Supervisory Committee Members within the compensation limits approved by the General Meeting of Shareholders.

Basic policy on the determination of remuneration

The compensation for the Company’s Directors (excluding Directors who are Audit & Supervisory Committee Members) will be determined based on the following fundamental principles:

- The compensation system should function effectively as an incentive for strong commitment to achieving the Company’s annual and medium- to long-term management plans and financial goals, as well as the sustainable enhancement of corporate value.

- The compensation level should be determined in consideration of surveys and other assessments of the status of domestic and international companies in the same industry conducted by external organizations.

Meanwhile, the compensation for Company’s Directors who are Audit & Supervisory Committee Members will consist of basic compensation (monetary compensation) and stock compensation (restricted stock compensation). This compensation will be determined through consultation among all Audit & Supervisory Committee Members, taking into account their responsibilities, economic conditions, and other relevant factors (provided that stock compensation will be granted only to those residing in Japan).

Overview of Remuneration for Directors and Audit and Supervisory Committee Members

| Type of Remuneration | Director Type | Maximum limit of remuneration | ||||

|---|---|---|---|---|---|---|

| Inside Directors (Excluding Directors who are Audit & Supervisory Committee Members) | Outside Directors (Excluding Directors who are Audit & Supervisory Committee Members) | Directors Who Are Audit & Supervisory Committee Members | ||||

| Fixed | Cash compensation | Basic compensation | ○ | ○ | ○ |

|

| Fixed | Non-monetary compensation | Restricted share compensation Restricted share conditioned on continuous service as a Director of the Company for a certain period. | ○ | ー (Not applicable to non-residents of Japan) | ○ |

|

| Variable | Performance- linked stock compensation (Restricted stock) An incentive for commitment to achieving the Company’s annual and medium- to long-term management plans and financial goals, as well as the enhancement of corporate value. | ○ | ー | ー | Up to ¥60 million / year | |

Remunerations for Directors (FY2024)

| Number of persons (Persons) | Total amount of remuneration, etc. (Thousand yen) | Total amount of remuneration, etc., by type | |||

|---|---|---|---|---|---|

| Basic compensation (Thousand yen) | Performance-linked compensation | Non-monetary compensation | |||

| Performance-linked stock compensation (Thousand yen) | Restricted stock compensation (Thousand yen) | ||||

| Directors(Excluding Directors Who Are Audit & Supervisory Committee Members) | 4 | 83,716 | 55,560 | 1,750 | 26,406 |

| (who are Outside Directors) | 1 | 6,000 | 6,000 | - | - |

| Directors Who Are Audit & Supervisory Committee Members | 4 | 23,308 | 16,200 | 0 | 7,108 |

| (who are Outside Directors) | 4 | 23,308 | 16,200 | 0 | 7,108 |

| Total | 8 | 107,025 | 71,760 | 1,750 | 33,514 |

*Notes are only available in Japanese.

Accounting audit fee

| Category | FY2023.06 | FY2024.06 | ||

|---|---|---|---|---|

| Audit certification service fee (thousand yen) | Non-audit service fee (thousand yen) | Audit certification service fee (thousand yen) | Non-audit service fee (thousand yen) | |

| Filing company | 44,550 | 8,850 | 44,000 | 20,656 |

| Consolidated subsidiaries | - | - | - | - |

| Total | 44,550 | 8,850 | 44,000 | 20,656 |

Scope of the Matters Delegated to Management Members

The Company has adopted a “company with an Audit & Supervisory Committee” system, which allows a significant delegation of the Board of Directors' executive authority to each Director. Pursuant to laws, regulations, the Articles of Incorporation, Board of Directors rules, and authority rules, the Board of Directors makes decisions on basic management policies, business plans, and significant business operations, supervises execution of duties of each Director, and actively discusses corporate strategies and others. To ensure agile decision-making, as defined in the Board of Directors rules, the Board of Directors determines the scope of executive authority to be delegated to each Director and management members based on the importance of decision-making and associated risks. Each director and management member executes duties within the delegated scope and reports important matters to the Board of Directors.

Compliance

Anti-Corruption Policy

Under its rules on compliance, the freee Group makes every possible effort to prevent any form of bribery and corruption both at home and abroad and makes no compromises on this commitment.

Scope of application

This policy applies to all officers and employees of the freee Group (including officers, regular employees, and contract employees). The freee Group also expects our business partners and other stakeholders to support this policy, and expects suppliers to support and comply with this policy.

Prevention of corruption

We at the freee Group categorically avoid any act of abusing our or a third party's power or position related to duties, such as bribery, misappropriation, extortion of illegal profit, and illegal bids, any other act taken for personal benefit, or any act that could lead to a suspicion that we engage in any such act.

Prevention of bribery

In terms of prevention of bribery, we at the freee Group do not provide cash, gifts, entertainment, benefits, or other profit to third parties, including public officials and business partners in the private sector, whether directly or indirectly, for the purpose of exerting an inappropriate influence to win and maintain contracts or secure inappropriate advantage in businesses. In addition, we do not receive cash, gifts, entertainment, benefits, or other profit that could affect the freee Group's decision making.

Fair dealing

We at the freee Group comply with fundamental rules of Japan and other countries concerning fair dealing, including competition law, and are committed to acting in accordance with laws and proper corporate ethics.

Competition laws, such as the Act on Prohibition of Private Monopolization and Maintenance of Fair Trade, prohibit restricting fair and free dealing. Illegal transactions include the followings:

- Companies discuss and jointly determine selling prices, selling volumes, or production volumes for goods, which each company must independently determine, thereby restricting competition (cartel).

- In a bid for public works or public procurement of goods by the national government or a local government, bidding companies consult with one another in advance and collude to determine the winner of the bidding process, the amount of contract value, and others (bid rigging).

- A company, independently or jointly with other companies, attempts to exclude competitors from the market or obstruct the business of new entrants to monopolize the market by implementing unfair price undercutting, selling price discrimination, and other measures (private monopolization through exclusion).

- A company in the dominant position restricts other companies' business activities by acquiring shares in those companies, appointing their officers, or taking other measures in order to control the market (private monopolization through control).

All officers and employees of the freee Group (all employees including officers, regular employees, and contract employees) comply with these competition laws.

Related Party Transactions

As stipulated in the Board of Directors rules, transactions with conflicts of interest and competitive transactions are matters for resolution by the Board of Directors, and Directors with special interests are not allowed to participate in the deliberation and resolution on such matters.

Regarding transactions among related parties, the Operating Executive Officer in charge of the Corporate Division reviews the rationality (business necessity) and the appropriateness of the transaction terms, and then gives approval to related written requests for internal approval.

Protection of intellectual property

The freee Group respect and properly protect intellectual property rights duly owned by third parties. We properly protect intellectual property rights that we own.

Whistle-blowing system

The freee Group has put a whistle-blowing system in place to collect information related to an act in the Group that violates or could violate laws, regulations, etc., in the early stage and correct such act and thereby advance its compliance management.

The whistle-blowing office has set out the rules on whistle blowing, established the three contact points, the in-house hotline, the Audit and Supervisory Committee hotline, and the external hotline (a law office), all of which employees and officers of the freee Group can use, and has also made it a rule that Audit and Supervisory Committee Members deal with cases where an executive officer or officer is involved in order to secure independence from executives.

If a report is received, a thorough investigation is conducted, and if it is confirmed, corrective actions are taken. Under the system, it is ensured that a whistle blower will not receive unfavorable treatment due to the reporting to the whistle-blowing office.

Mission as social infrastructure

As we provide so many customers with services that contribute to enhancing efficiency in small businesses, we consider the freee Group's services as social infrastructure. We are striving to maintain stable operation of our services so that customers can always use our services with a sense of security.

The freee Group's services handle customers' important information assets. To protect these information assets, we have established a dedicated information security team, and ensure proper management and protection of information assets. Specifically, we have acquired the SOC1 Type 1 report and SOC1 Type 2 report, internationally recognized warranty reports, and the TRUSTe certificate, an international certificate related to protection of personal information, with respect to freee Accounting, and implemented information protection measures in compliance with relevant laws and regulations. In addition, in the authorization process for electronic settlement service agents, we are assessed by the Financial Services Agency for the compliance with security standards based on the FISC Security Guidelines. Moreover, we have established our Basic Policy on Information Security, and have continuously provided training programs and security failure simulation programs for our employees.

We have disclosed the freee Group's information security policy and measures in the Security Whitepaper.

Strengthening our business continuity system

The freee Group has formulated its crisis management manual and made it a policy to prioritize the lives and safety of its employees and their families and strive to continue to deliver value to customers by sustaining the provision of services. We also deliberate on measures for material management risks and other important matters in terms of risk management at the Risk Management Committee and, as needed, report to the Board of Directors for deliberation.